louisiana state inheritance tax

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. The state income tax rates range from 1 to 575 and the general sales tax rate is 4.

State Estate And Inheritance Taxes Itep

Find out when all state tax returns are due.

. Inheritance taxes can apply regardless of whether the deceased person had a Louisiana Last Will and Testament or died intestate. Addresses for Mailing Returns. Community property laws may have tax consequences affecting property and inheritance of property.

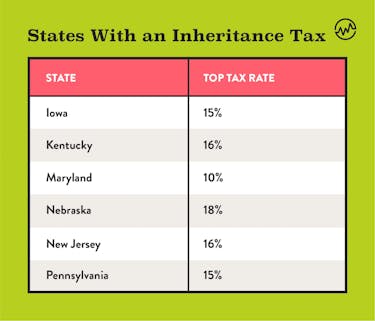

An inheritance tax is a tax imposed on someone who inherits money from a deceased person. These states include Indiana Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Estate Planning Last Wills Last Will State Requirements Living Trusts Living Wills Estate Planning Basics Inheritance Cases Top Get helpful tips and info from our newsletter.

Often these different tax laws are scattered throughout the states codes and are not codified together into a cohesive tax code Accordingly. Twelve states and Washington DC. California Franchise Tax Board.

Maryland is the only state to impose both. Like the Federal estate tax laws Louisianas inheritance tax laws have undergone a lot of changes in the past several years. Bulk Extensions File your clients Individual Corporate and Composite Partnership extension in bulk.

Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less. States youll have to file a state tax return. Impose estate taxes and six impose inheritance taxes.

Property taxes sales use taxes excise taxes estate and inheritance taxes and liquor taxes. Credit Caps See the estimated amount of cap available for Solar tax credits and Motion Picture Investor and Infrastructure tax credits. There are several states with an inheritance tax.

In some ways state and local taxation closely resembles the federal taxation scheme. Even though most of us file our taxes every year its easy to be a little confused about them. State Individual Income Tax Rates and Brackets for 2021 Accessed Dec.

State Tax Law. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Jurisdictions located in the state may charge additional sales taxes. State of New Jersey Office of the Governor. What states have an inheritance tax.

2021 540 California Tax Rate Schedules Accessed Dec.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Estate Tax Rates Forms For 2022 State By State Table

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Louisiana Inheritance Laws What You Should Know Smartasset

Recent Changes To Estate Tax Law What S New For 2019

Louisiana Inheritance Tax Estate Tax And Gift Tax

Estate Tax Examples Of Estate Tax Estate Tax Rate

State Estate And Inheritance Taxes Itep

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How Is Tax Liability Calculated Common Tax Questions Answered

Louisiana Inheritance Laws What You Should Know Smartasset